Military Mortgage Assistance - All three lenders design military home loan products specifically for the needs of military personnel. The Defense Bank and Australian Bank of Australia are specifically designed to meet the financial needs of ADF personnel. You can also talk to a mortgage broker to assess your eligibility for these plans and which lender is right for you.

If you are a veteran in crisis or are concerned about one, contact our caring and trained veterans crisis line responders for confidential help. Most of them are veterans themselves. This service is confidential, free and available 24/7.

Military Mortgage Assistance

Source: varc.sdes.ucf.edu

Source: varc.sdes.ucf.edu

Chat online with qualified VA staff. You'll also need to show that you qualify for a veteran's pension. Most lenders look for the following pensions when considering your loan application. FHFA Acting Director Edward DeMarco highlighted the importance of these new programs in a press release: “It's in everyone's best interest to focus on the important work our service men and women do to protect our country.

, instead. rather than worrying about property repairs and rentals elsewhere." Contact a Fannie Mae Mortgage Assistance Network Partner - If your loan is managed by Fannie Mae, you can meet with an experienced housing counselor (by phone or in person) to learn more about your mortgage situation and services.

to discuss the options available to members. Click here to confirm Fannie Mae loan eligibility and request assistance. The White House encourages service members and their dependents who believe they are disqualified under the SCRA to contact their nearest Military Legal Aid Office

Office locations can be found online by clicking on the Legal Services section. Whether you want to stay in your home or move out, there are many different mortgage programs available to help you. Click on each link to see the details, benefits, and next steps for that option. Payment

if you skip it or get a very low interest rate Learn about the signs of a misleading commitment to refinance your VA-guaranteed home loan. This place is safe. https:// means you are connecting to a legitimate website and any information you provide will be encrypted and sent securely.

The Google Translate feature is a third-party service provided for informational purposes only. Fannie Mae cannot guarantee the accuracy of translations in the application and is not responsible for any accidents or injuries caused by the use of translations made by the Google Translate function.

Whether you're based in Australia or overseas, applying for a home loan is easy. What may differ is the process depending on whether you are active or active in combat: If you are applying for a home loan as a retired ADF member, you may still be able to take out a loan against your veteran's pension.

All you have to do is prove that you are financially able to make the payments, and your income will last until the end of the loan term. Few lenders are willing to accept a veteran's pension as a source of income, so you should contact an experienced mortgage broker before applying for a loan.

However, some banks have a traditional approach to lending policies and do not consider these benefits when calculating your eligibility for a loan. The trick is to find lenders who are willing to consider these benefits to help you with your Australian Defense Force Home Loan application.

"People who work for our country deserve the best service from mortgage brokers," said Richard Cordray, director of the Consumer Financial Protection Bureau (CFPB). Constantly changing the order of channels can make it difficult to make decisions about the ownership of service premises, so people may not have them.

This guide specifically warns mortgage brokers that this country has important laws to help military members in the housing market. “If your overseas shipping time exceeds six months, it may be considered longer. In this case, you may be eligible for many attractive offers and benefits.

Source: i.pinimg.com

Source: i.pinimg.com

The idea behind this is to offset the costs and hassles of moving and setting up residence abroad. Depending on your rank and length of service in the ADF, you may be eligible for a home loan.

Qualifying for a military home loan depends on a number of factors, including how long you've been employed. If you are a member of the Australian military and have served for a number of years, you are well paid.

This means that more than 80% of the purchase price can be borrowed. However, the lender may require you to purchase Lender's Mortgage Insurance (LMI), which protects the lender from financial loss. As a COE survivor of a veteran or missing or detained military spouse, find out if you qualify and how to apply for a VA home loan.

DHOAS is administered by the Department of Veterans Affairs on behalf of the Department of Defense. There are currently three lenders authorized to issue DHOAS mortgages, Bank of Australia, Defense Bank and NAB. Some new coverage is available for service members with PCS.

Because PCS often requires quick action, service members are at risk of financial loss, especially if they owe more on their mortgage than their home is worth and may end up selling their home at a loss.

A veteran's pension is a guaranteed, regular income that lasts until the end of the loan term, which helps qualify borrowers. Hence, you can qualify for the same mortgage interest benefits as people on fixed incomes.

Source: www.tsahc.org

Source: www.tsahc.org

VA housing assistance helps veterans, military personnel and their surviving spouses buy a home or pay off a mortgage. We also offer benefits and services to help you build, improve and maintain your existing home. Learn how to apply for and manage the Veterans Housing Assistance benefits you receive.

You can be in the Army, Air Force, Navy, active combat or support staff. Your responsibilities may require you to work abroad. This allows you to get various benefits and benefits to cover any additional costs that may arise.

This is a big change for military personnel, who have to move more often than their regular counterparts due to the demands of military life. About 33% of the workforce needs to move every year. These continued moves could leave them vulnerable to falling housing prices.

This new system will help reduce this pressure. You can also get a second loan on your home loan, and depending on your eligibility, you can borrow up to 95% of the property's value. However, the lender may ask you to pay LMI on the loan.

The government is deeply concerned about firms requiring military personnel to waive their military membership rights before the firms provide assistance. In some cases, military personnel have been advised to stop paying their mortgages and have been injured as a result.

We offer many programs and services that can help, including free health care and, in some cases, limited free dental care. We can help connect you with resources in your area, such as homeless shelters and religious organizations.

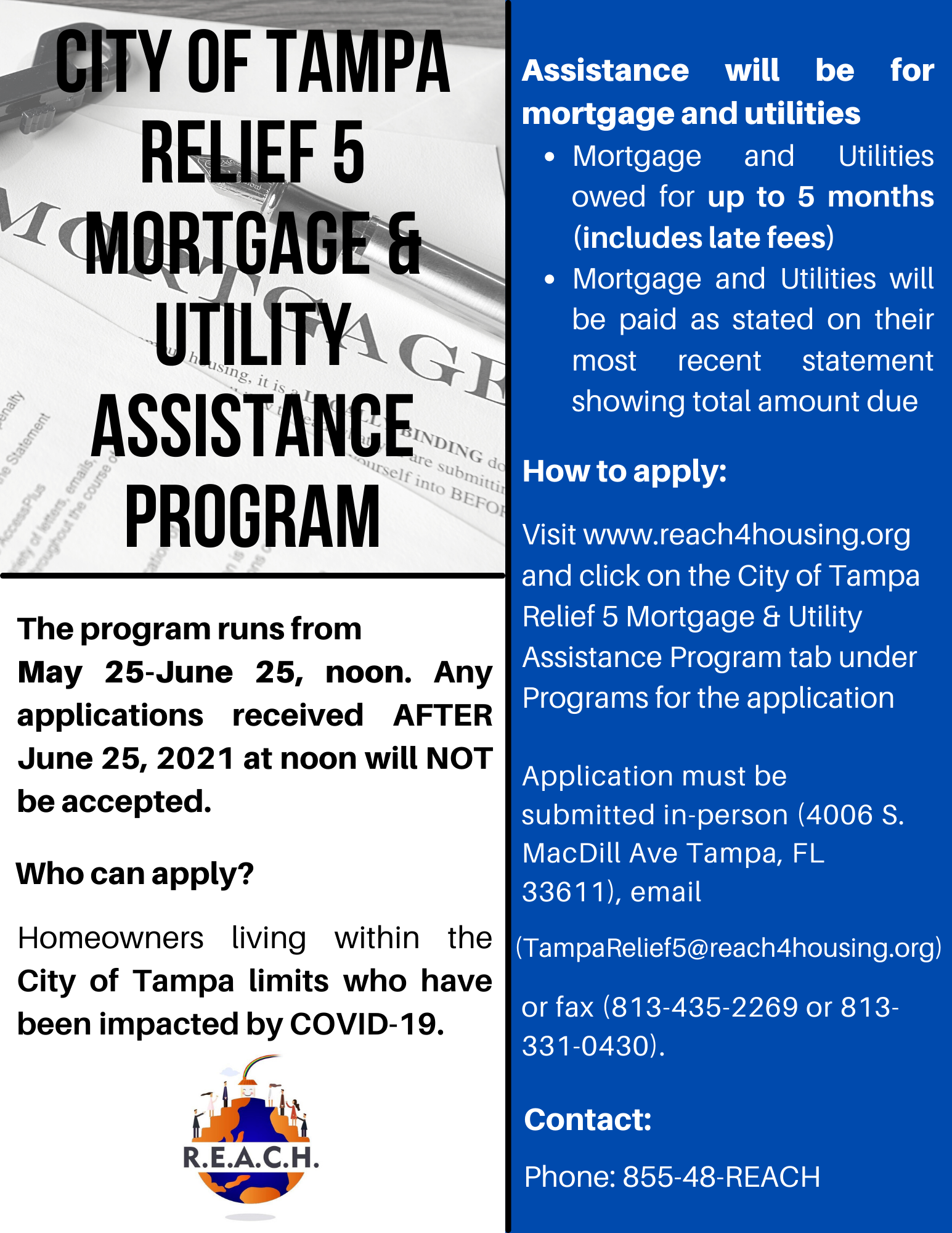

Source: reach4housing.org

Source: reach4housing.org

The White House intends to make this assistance available to veterans and service members, including those affected by unfair spending and excessive interest, as part of a concerted effort to improve the economy by increasing refinancing opportunities through the HARP program and reducing FHA refinancing.

fees. process. Regardless, all veterans and military personnel must take advantage of all available assistance programs. There are many lenders in Australia, including the Big 4, that offer home loans specifically for military and defense personnel.

You can start your research by comparing home loans online or contact an individual lender or mortgage broker for help. PCS is considered distressed - If you have a loan guaranteed by Fannie Mae or Freddie Mac and you have a PCS, you may be able to sell your primary home purchased before June 30, 2012 for less than you owe.

mortgage balance. You don't have to pay late or default on your mortgage. If your home sells for less than you owe, you won't be responsible for the balance as long as you have a Fannie Mae or Freddie Mac loan.

You can check online to see if Fannie Mae or Freddie Mac supports your loan. A veteran's pension (also known as a defense pension) is paid to a person who has served in the military or the dependent of a person who has served in the military.

Widows of war veterans are also entitled to this pension. The ADF has Defense Housing Loans available to highly paid military personnel. These loans are available at highly subsidized rates, making it easier for ADP employees to own a home.

Source: www.anmtg.com

Please inquire with the Defense Home Loan Association which bank has entered into an agreement with this government loan. Most lenders will approve your home loan with a 5 percent down payment. If you can't pay your mortgage, you can apply for a foreclosure if you're using a guarantor.

You may also be eligible for programs such as the Home Buyers Assistance Scheme (HPAS) and the First Home Owners Grant (FHOG). Both of these plans can help you finance your purchase. In June 2012, a new program was introduced to help tens of thousands of veterans and service members struggling with underwater homes.

The program extends the government's previous national loan repayments with some major banks and increases enforcement of the Civil Servant Relief Act. The Military Housing Assistance Fund (MHAF) is the foundation of Virtual Sports Academy and operates a home purchase assistance program for active duty military veterans and their families.

Our unique approach to the home buying process allows you to receive gift money that can help offset a portion of the closing costs of your home purchase. Applying for a home loan as a military member can be a different experience compared to a salaried professional.

Lenders can easily check your creditworthiness with pay stubs and bank statements. However, as a member of the military, a portion of your financial compensation is often in benefits that other creditors may not enjoy.

emergency mortgage assistance for veterans, military mortgage relief, military home buying assistance, military mortgage benefits, military closing cost assistance program, veterans mortgage assistance, army mortgage assistance, military homeownership assistance program

0 Comments